Tuesday, July 31, 2018

Sunday, July 29, 2018

Wednesday, July 25, 2018

Tuesday, July 24, 2018

Sunday, July 22, 2018

More About Paytm KYC

More About Paytm KYC

- Paytm wallet is a RBI governed wallet and as per RBI mandate we need to do KYC of customers to enable a number of features.

(Refer to point 9 in RBI’s new guidelines)

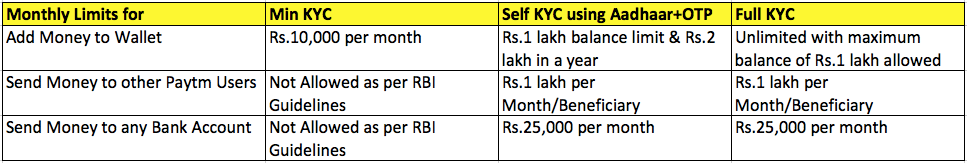

Various Limits for different types of KYC

- Click on KYC icon in your Paytm app and follow the steps. When you go to nearest Paytm KYC center or schedule a home appointment, it is always preferred to use Aadhaar as document ID as it allows biometric based KYC which in instant and 100% paperless .

FAQ (Frequently Asked Question)

Q1: Why do you need Aadhaar for Paytm wallet if Supreme Court has extended indefinitely linking of Aadhaar for Bank account?

Ans : Aadhaar is one of the means of proving your identity for increasing wallet limit. You can also KYC at Paytm using Passport, Voter Id, Driving license or NREGA card

Q2: Why do you ask for only Aadhaar for KYC?

Ans : Aadhaar is not the only document using which KYC can be done. However we prefer Aadhaar since you can do KYC yourself using it on Paytm app. If you want to do non-Aadhaar KYC, then request for the home visit from Paytm App & inform the Paytm executive to carry out non-Biometric KYC. Non-Biometric KYC process can take up to 4–5 days for approval

Q3: What is Paytm Payments Bank Limited? Why does Paytm wallet terms and conditions and SMS mention Paytm Payment bank (PPBL)?

Ans : Paytm Wallet is issued by Paytm Payment Bank, hence all legal terms and conditions mention PPBL. Paytm Payments Bank is India’s only mobile-first bank with zero balance — zero digital transaction charge. Paytm offers Paytm wallet and Savings bank account from Paytm Payment bank.

Q4: Why are you opening Bank Account while doing KYC? Can the agent who is doing my KYC also open my Bank account?

Ans : we don’t open Bank account as part of KYC. To open a bank account Paytm agent will need explicit consent from you. The agent will ask for another SMS to take confirmation from you. You will be sent an SMS which will mention One time code( OTP) for this confirmation. Just dont share this OTP if you dont want bank account.

Q5:I think I have accidentally given my confirmation for bank account but I don’t need bank account

Ans : You still have 2 days to cancel bank account opening, call 0120–3002699 and press 1.

Q6: What are charges for KYC?

Ans : There are no charges for KYC. It is completely FREE

Q7: Why do you collect additional details post verifying my Aadhaar?

Ans : RBI requires all wallets to be CERSAI complaint (Refer to point 57 in RBI directive). Therefore we are required to capture additional details needed which are not available in your Aadhaar data shared by UIDAI

Q8: Why KYC itself is a in person process. Why can’t I do it on Paytm app?

Ans : KYC requires Address proof of customer. You can do this verification using Aadhaar on Paytm app. However if no mobile is linked to your Aadhaar a Paytm agent will need to do in-person verification of your Aadhaar or any other Govt id to do with KYC.

Q9. What are charges for KYC?

There are no charges for KYC. It is completely FREE. We don’t charge you a penny for the Paytm KYC and we never will. Please never pay anyone for your KYC even if asked. Please alert us immediately if anyone asks you for money to get your KYC done.

Q10. Can the agent who is doing my KYC also open my Bank account?

No the agent will have to take another confirmation from you. You will be sent another SMS which will mention One time code(OTP) for this confirmation. Just dont share this OTP

Q11. What if I don’t do KYC?

Your existing balance can be used like before. However, you will have to provide one government issued ID like Aadhaar, Voter Card, Driving License or Passport and you can continue adding more money to wallet. After that, you would also be able to receive cashbacks. Submit your government issued ID here http://m.p-y.tm/minkyc

However, only KYC users will be able to transfer money to each other using Paytm and send money from their Paytm Wallets to their bank accounts.

Q12. What happens when I hit my wallet limits of Rs.10,000 and I have not done my KYC?

You will not be able to add money to your Paytm Wallet or receive any cashback within that month. If your cashback amount is higher than Rs.10,000, you will be prompted to get your KYC done to receive that money in your Paytm balance.

Q13. I have not done my full KYC. Can I still receive money from other Paytm user?

You can continue to receive money from other Paytm users if you have given any document ID at the time of sign up or here http://m.p-y.tm/minkyc.

Note that sender needs to mandatorily complete KYC before sending you any money

Q14. I am a KYC user but I still can not send money?

As per RBI guidelines, you can send only upto Rs.10,000 in a month to any user. However, to send more money, you will have to add the user as beneficiary. This option is available under Paytm App > Profile > Manage Beneficiary (update your App to latest version to see this). You can add a beneficiary there and can send upto Rs.1 lakh to another user in a month

Q15. I have money in my Paytm balance and I have not completed my KYC. Will I be able to use this money?

Any money in your Paytm balance belongs to you and you will be able to use this for all kinds of payments except sending money to others or sending it to your Bank account.

Q16. What are the documents needed to complete my KYC?

In order to complete your KYC, we need to verify your Aadhaar details. Alternatively, you can also submit other Govt approved ID proof like Voter ID Card, NREGA Card, Passport and Driver’s License

Q17. How much time will it take to complete my KYC?

You can get your KYC done instantly using your Aadhaar details in Paytm App. Alternatively, you can also go to a nearby center and get your verification done. For those scheduling a home appointment , it may take up to 7 working days to schedule a visit and complete your KYC.

Q18. Are there any limits on KYC-enabled Paytm Wallet?

The balance in your Paytm Wallet at any point in time cannot exceed Rs. 1 lakh.

Q19. What are the charges for sending money to the bank for KYC users?

You would pay 3% charge to send money from your Paytm Wallet to your bank account. Non-KYC users won’t be able to use this service from 1st March 2018.

Q20. What are the charges for sending money to other users?

There will be no fee to send money to other Paytm users. Non-KYC users won’t be able to use this service from 1st March 2018.

Q21. Can I still make payments at any shop without KYC?

From your existing balance and through UPI, you will be able to make payments at any shop even if you are not a Paytm KYC user. However, to add more money, you need to provide us any one document ID here: http://m.p-y.tm/minkyc

Q22. Can I still use Paytm at Uber, Zomato, Swiggy and all other apps where I have linked my Paytm without getting KYC done?

You would be able to use your existing balance for all online payments. To add more money, submit your government issued ID here: http://m.p-y.tm/minkyc

Q23. Will I get cashback if I have not done my KYC?

You will have to provide one government issued ID like Aadhaar, Voter Card, Driving License or Passport and you can continue getting the cashback. Submit your government issued ID here http://m.p-y.tm/minkyc

Q24. How much money can I send to my bank account from my wallet?

KYC users can send up to Rs.25,000 from their wallet to Bank account every month.

Q25. How can I add money to Paytm wallet?

You can continue to use all payment options to add money including Credit Cards, Debit Cards, Net Banking & UPI. There are no charges whatsoever when you add money to your Paytm Wallet.

Get Rs.10 Free Recharge From Paytm App

Before Proceed Must Read The FAQ Which Is Mentioned Below!!

Get Rs.10 Free Recharge From Paytm App

1)👉 Open Paytm App - Login Your Account.

2) 👉Go to Recharge Section & Enter Your Mobile Number & Select Operator As Idea Only & Amount As Rs.10

Note: Make Sure To Select Operator As Idea Only, Doesn't Matter Your Operator Is Aircel,Airtel,Tata, Etc.

3) 👉Proceed To Pay -> Apply Promo Code As- CQQWYWW3TUWV

4) 👉Complete The Transaction Via Any Payment Method, You Will Get The Cashback With 24 Hours!!

FAQ (Frequently Asked Question)

🔵 Is This Offer Is Working For New User Or Old?

-> Offer Is Work For All Either New Or Existing.

🔵 How Many Time Can I Avail This Offer?

-> You Can Avail This Offer Unlimited Time Until The Coupon Limit Has Been Reached.

🔵 Does This Offer Working For All Operator?

-> Yes This Offer Is Work For All Operator, You Just have To Select Operator As Idea Only In Order To Get Success.

🔵 What Is The Offer Duration?

-> This Offer Is Working Daily Between 7:40 Pm To 7:50

But But But According To Me The Coupon Code Is Live Exact At 7:46 Pm To 7:49 Pm Everyday.

Friday, July 20, 2018

Wednesday, July 18, 2018

Monday, July 16, 2018

Sunday, July 15, 2018

Amazon Brand - Solimo XL Bean Bag Cover Without Beans (Red). ₹289/-

Mrp -- ₹499/-

Deal Price -- ₹289/-

Saturday, July 14, 2018

Pepperfry What The Fry deals 15th July

Abstract Nylon 15 x 23 inch Anti Skid Door mat By Status at

₹59

Dynamic Store Silver Stainless Steel Sauce Bowl, 60 ML, Set of 6 at ₹75

Dynamic Store Classic Strainer- Set of 2

at ₹79

Orient Electric 18 Watt Cool Day Light Led Batten

at ₹279

Gold Metal Portuguese Hanging Light by Aesthetic Home Solutions

at ₹399

Now You Can Do Mobile Recharge by Facebook.

Now You Can Do

Mobile Recharge by

Source

👇👇👇

But there is no Offers

That's why it's not

Popular

Note -- It's Available only on Facebook app

Not in Desktop and nor in FB lite

The Lugai Fashion Black Cotton Cold Shoulder Women Tunic Short Top for Jeans Top for Daily wear Stylish Casual and Western Wear Women/Girls Top. @99/-

The Lugai Fashion Black Cotton Cold Shoulder Women Tunic Short Top for Jeans Top for Daily wear Stylish Casual and Western Wear Women/Girls Top

Loot Price - ₹99/-

Wednesday, July 11, 2018

Edifier K815 Headphones (White) @799/-

Edifier K815 Headphones (White)

Mrp -- @3799/-

Deal -- @799/-

Deals4you Premium Quality Mens Sports Blue Shoes @199/-

Deals4you Premium Quality Mens Sports Blue Shoes

Mrp -- @499/-

Deal --@199/-

Size -- 6

Deal with @299 other size

Kitchen Closet New Arrival Limousine Blue Colour 1 Litre Water Bottles (Pack Of 3) @179

Kitchen Closet New Arrival Limousine Blue Colour 1 Litre Water Bottles

(Pack Of 3)

Mrp -- @199/-

Deal -- @179/-

iLuv FitActive Run Stereo Headphones (Red) @249/-

iLuv FitActive Run Stereo Headphones (Red)

Mrp --₹1779/-

Best Deal -- ₹249/-

Edifier H210 in-Ear Headphones – Black , Best Deal @299/-

Edifier H210 in-Ear Headphones – Black

Mrp -- ₹2979/-

Best Deal -- ₹299/-

Tuesday, July 10, 2018

Airfree E60 Filterless 45-Watt Air Purifier (White)

Airfree E60 Filterless 45-Watt Air Purifier (White)

Mrp -- ₹1499/-

Deal -- ₹3630/-

Nivea Pure Impact Shower Gel, 500ml @175

Nivea Pure Impact Shower Gel, 500ml

Mrp -- @349/-

Deal -- @175/-

Aurion WHG Wood Hand Grip Set, Pack of 2 (Brown) @79/-

Aurion WHG Wood Hand Grip Set, Pack of 2 (Brown)

Mrp --@171/-

Deal -- @79/-

Subscribe to:

Comments (Atom)